THE DEED BRIEF

📊 QUICK POLL (5 sec - no wrong answers)

When you negotiate, what’s your go-to first ask? (We’ll share results + tactics next week.)

When you negotiate, what’s your go-to first ask?

📊 LAST WEEK’S RESULTS

If you’re like most Deed Brief readers, your eye goes to listings that are seasoned—not stale.

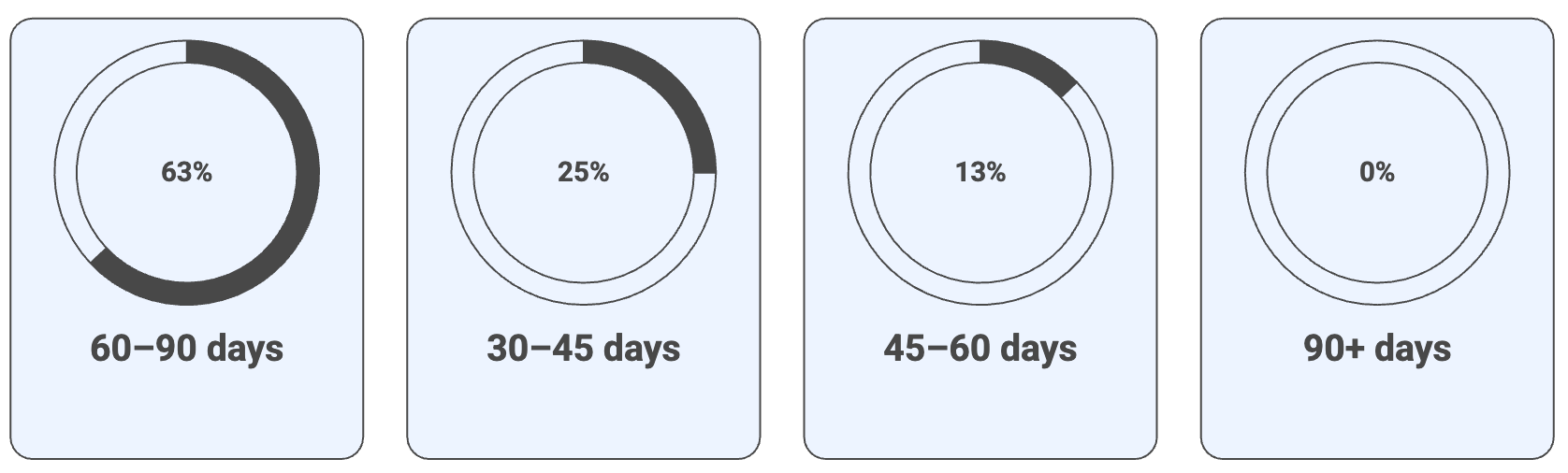

Which DOM range would you target first? (Results from last week’s poll.)

If you picked 60–90: You have a calm timing instinct—you wait until sellers are realistic and $/mo credit asks land.

If you picked 30–45: You’re the early spotter—you like softening before the crowd notices.

If you picked 45–60: You time the first price cut and move while emotions are fresh.

If you skipped 90+: You screen out zombies; time isn’t value if motivation is gone.

⏳ TL;DR

Q: How do you know—right now—if sellers in your market will negotiate?

A: Pull three numbers: MOS (months of supply), DOM (days on market), and % price cuts. When DOM is ~60+ and there’s a recent price cut, credit/points requests land far more often. Always analyze the ask in $/month (e.g., “$47/mo lower” beats “$9k credit”).

WHAT MOST PEOPLE MISS

$/mo beats % off. Always translate your ask to payment.

DOM 60+ + fresh cut = green light in many ZIPs—confirm locally.

Hot pockets ≠ credits. New/turnkey/underpriced listings still go competitive—switch to Speed & Certainty there. See last week’s newsletter Day 60+: when “no credits” becomes “let’s talk”

🧲 MARKET CHECK (YOUR LEVERAGE RADAR)

THE SUPPLY LINE IS SOFTENING

Rates: 30-yr fixed 6.22% (week ending Nov. 6). Freddie Mac

Supply: ~4.6 months (Sept). Nationally near “balanced,” but metro splits matter. National Association of REALTORS®

Time on market / inventory trend: October Realtor.com data is out: median days on market ~63 and active listings up YoY. Realtor

Rents/vacancy: National rent roughly flat YoY; vacancy ~7.2% (near record). Underwrite Year-1 conservatively. Apartment List

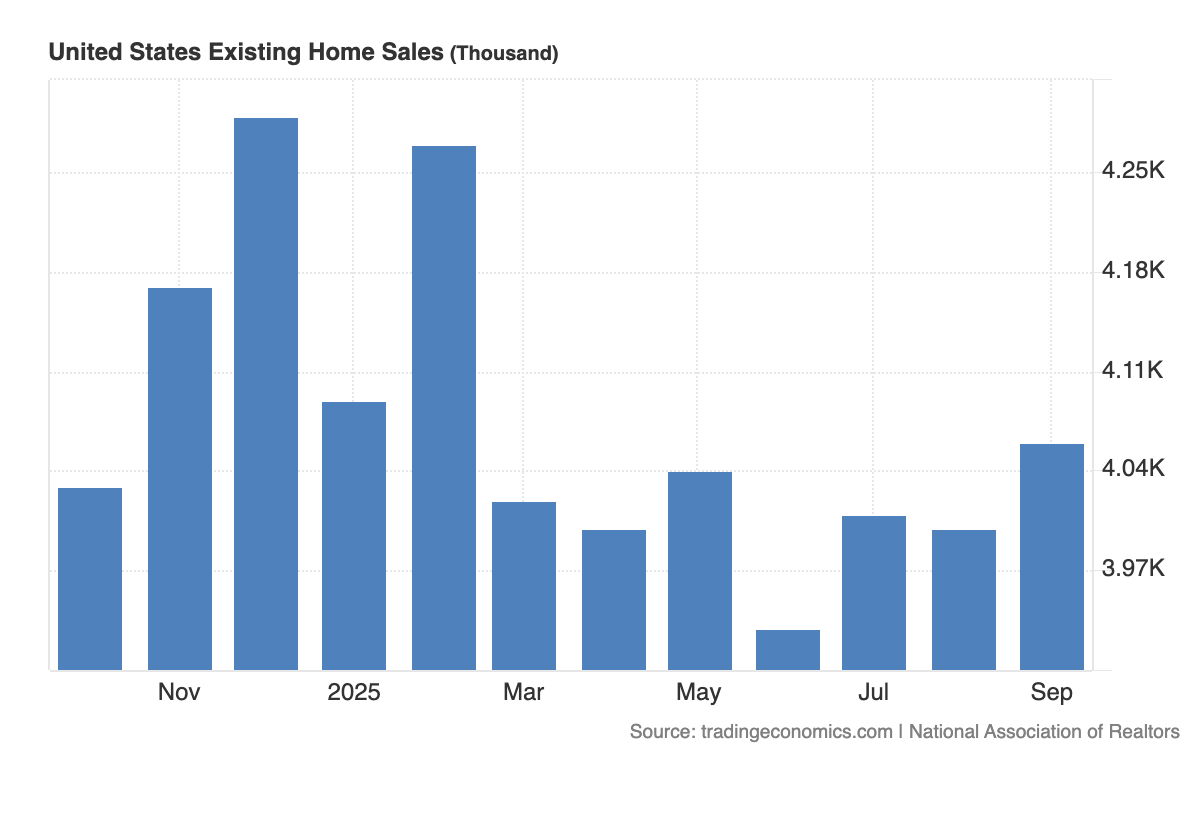

Existing Home Sales

Mini legend: 📦 MOS ≥6 buyer-leaning • ⏱ DOM ↑ seller anxiety • ✂️ Price cuts ↑ ask for credits

Our take (Prove-It view): We’re not calling a broad “buyer’s market.” But in ZIPs where DOM is climbing and price cuts are common, your odds of landing credits jump. Run the numbers—don’t inherit the headline.

🏡 THIS WEEK’S MOVE

PROVE-IT TEST — 3 NUMBERS IN 3 MINUTES

MOS: Check if your metro is ≥6 months.

DOM: Is the trend rising vs last month/last year?

Price cuts: What share of listings reduced price recently?

WHERE TO LOOK (helpful links):

Realtor.com Market Trends (MOS)

Redfin City Pages (DOM & price drops)

TradingEconomics (downloadable charts)

Do: If 2 of 3 lean your way (e.g., DOM ↑ and price cuts ↑), lead with a credit instead of just price.

🧑💻 INVESTOR CORNER — REAL EXAMPLE (educational)

The question: DOM 68 + 2% price cut. On a $445,000 SFR, is a 2% seller credit stronger than another price shave?

Numbers (conservative):

Baseline PITI (Two-Call): ~$2,610/mo

Nearby rentals show “1 month free” → effective rent ~$1,925/mo

$10k price cut: ≈ $67/mo impact

2% credit to points (~$8,900): ≈ $110–$150/mo impact (at ~6.2–6.4%; verify with your lender)

Why it might work: 60+ DOM + recent cut = seller prioritizes certainty; $/mo framing lands.

Why it might not: Hot micro-pocket or underpriced home may still draw bids.

Our take: In this scenario, we’d lead with the credit (converted to $/mo), keep price near ask, and solve their DOM problem with speed + certainty.

🔎 DEAL DECODER

CREDITS VS. PRICE (the 60-second chooser)

Hold ≥24 months? Consider permanent buydown (only if payback ≤24 months).

Might refi/move sooner? Prefer credits (closing costs or temporary buydown).

Rates falling? Credits preserve refi flexibility.

Rates rising? A price cut has permanent value.

🎯 One Action (90 seconds)

Name a saved search “DOM ≥60 + Cut — [ZIP]”. When a match hits, run Two-Call, convert a 2% credit to $/mo, and message your agent to negotiate.

🔥 When the Listing Is Actually HOT

Run the Speed & Certainty package: fully underwritten pre-approval, inspection for info (keep safety), flexible close, capped escalation, appraisal plan, and backup-offer ready. Speed + certainty often beats highest price. Day 60+: when “no credits” becomes “let’s talk”

🌐 SOURCES

PMMS (Nov 6): 30-yr fixed 6.22%. Freddie Mac

NAR (Oct): Inventory ~4.6 MOS. National Association of REALTORS®

Realtor (Oct): Time on market ~62 days, active listings up 17% YoY. Realtor

Redfin (Oct 2): Share of price drops at a record seasonal pace; deeper buyer discounts vs 2019. Redfin

Apartment List (Oct 29): Rents −0.9% YoY; vacancy 7.2% (record). Apartment List

TradingEconomics: Housing data, downloadable charts

⚖️ COMPLIANCE

Education, not financial/legal/tax advice. Markets vary by ZIP and property. Verify taxes, insurance, rent, and local rules before acting.

Until next time,

Your 10-minute real estate playbook starts here