THE DEED BRIEF

📊 QUICK POLL (5 sec - no wrong answers)

What’s your #1 blocker right now?

📊 LAST WEEK’S RESULTS

When do you check real taxes & insurance?

Before touring: 66.7% (pro move)

After offer: 16.7%

During inspection: 16.7%

Our take: Pros close info gaps early. We’ll keep tuning the Two-Call so you can lock real PITI in minutes.

⏳ TL;DR

Q: What does Fannie Mae’s latest outlook mean for investors right now?

A: Nationally, the forecast points to a gradual improvement (no crash, no rocket). In that “slow-thaw” world, your edge is local: MOS (months of supply), DOM (days on market), and % price cuts. When your ZIP shows DOM ≈60+ and a recent price cut, seller credits/points land far more often. Do your math in $/month privately; present the ask as same-net credits + faster, cleaner close (not percent-off).

WHAT MOST INVESTORS MISS

Macro ≠ your micro. National averages hide ZIP-level leverage pockets.

Certainty trades win. In a slow market, sellers value speed/clean terms as much as price.

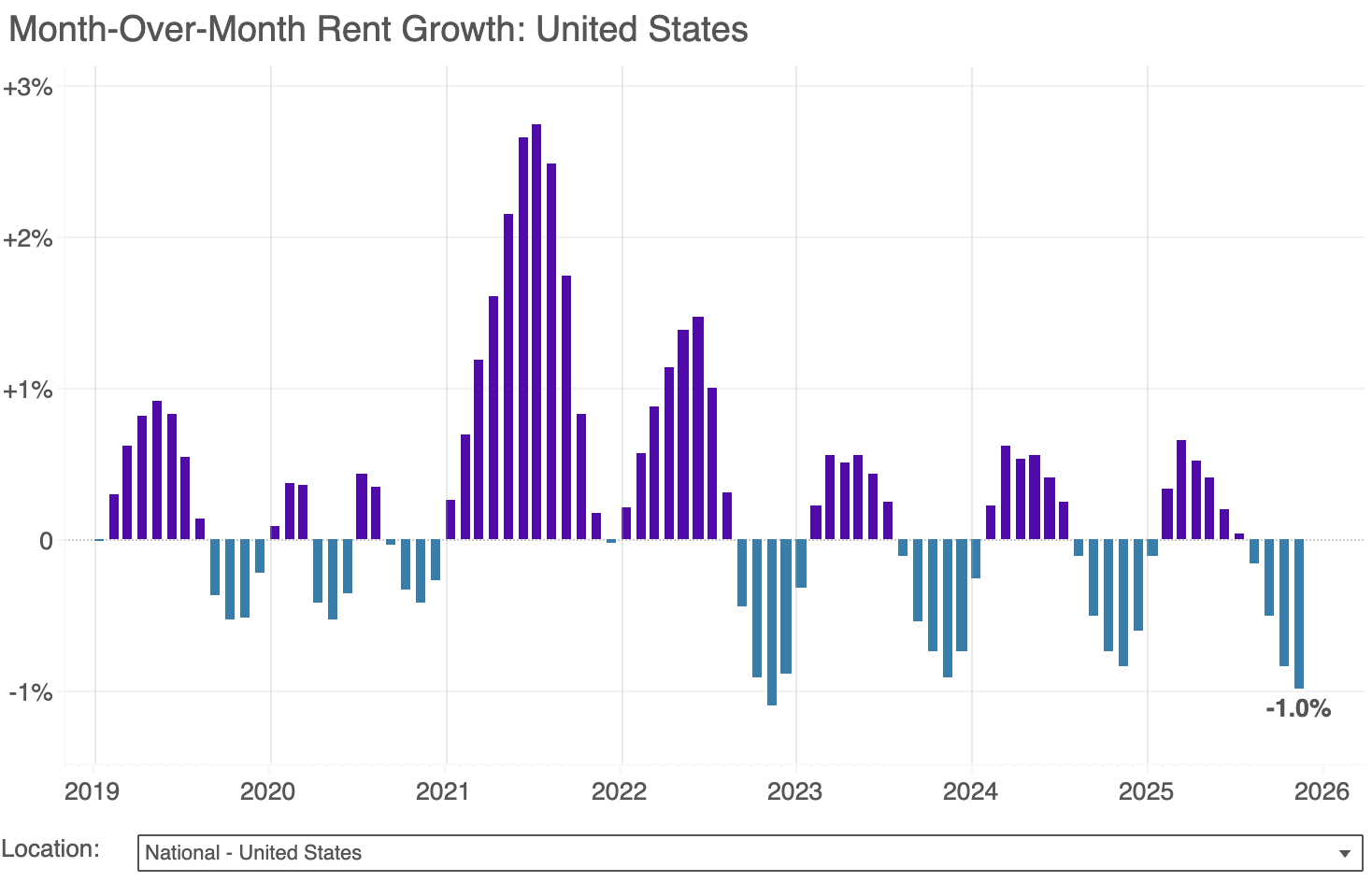

Rent reality matters. Soft concessions nearby? Underwrite effective Year-1 rent before you negotiate.

🧲 MARKET CHECK (INVESTOR INTEL)

Rates: 30-yr loans ~6.23% Freddie Mac

Rents/vacancy: National rent roughly -1% MOM; -1.1% YOY; vacancy ~7.2%. Apartment List

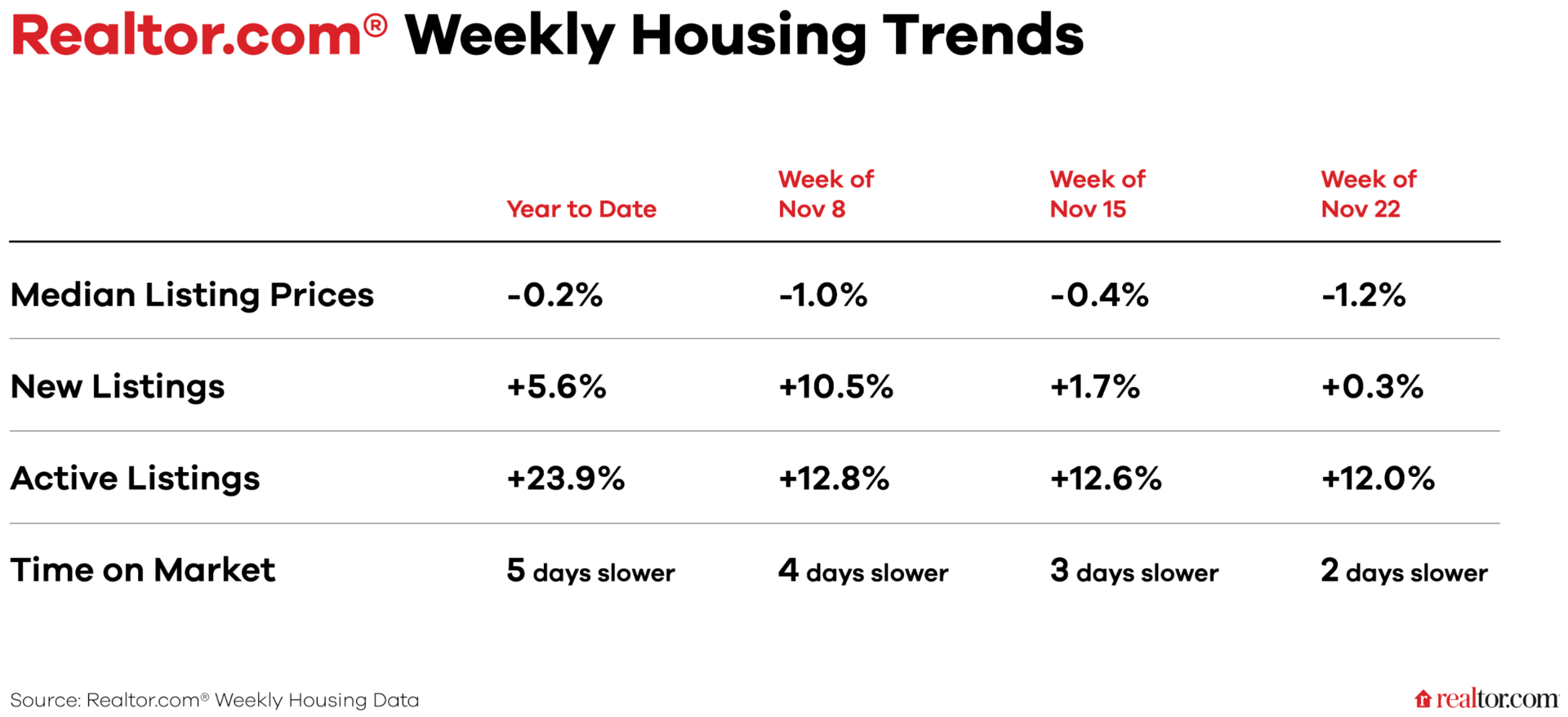

The backdrop: Fannie Mae’s November outlook points to muted sales volume near-term with a gradual recovery as borrowing costs ease over time—i.e., a long runway for negotiation, not a cliff or a sprint. Mortgage rates (PMMS) have drifted lower from their peaks, and resale inventory is taking longer to move in many metros.

Our take: Longer marketing times + cautious buyers = more stale listings → more credits (rate buydown, lock-extension paid, closing costs).

🏡 THIS WEEK’S MOVE

“Macro Map” to ZIP-Level Leverage (3 steps, 4 minutes)

Screen: Pull MOS, DOM trend, % price cuts for your ZIP (or nearest city page). If DOM ~60+ and price cut in last 30 days, tag it.

Underwrite: Run Two-Call (county tax + landlord insurance) to lock real PITI. If apartments nearby are advertising promos, convert asking rent → effective Year-1 rent.

Negotiate: Ask for a 2% credit sized to hit your target payment (internal $/mo math) and present it as same net to the seller with speed/certainty.

🧑💻 INVESTOR CORNER

“OUR TAKE” ON THE OUTLOOK

Macro view: Fannie’s base case favors a slow-thaw—no flood of forced sellers, no V-shaped rebound.

Our take (how to play it):

Hunt time, not headlines. Your leverage is time on market + recent cuts, not whether CNBC says “buyer’s market.”

Solve the seller’s problem. They fear more time; you offer speed & certainty (fully underwritten approval, tight timelines) in exchange for credits that solve your payment.

Price vs. credits: In a drift-down rate world, credits toward a permanent buydown often beat a straight price cut—if payback ≤24 months. Otherwise, take a modest price shave and keep refi flexibility.

🔎 DEAL DECODER

THE INVESTOR'S NEGOTIATION LADDER

Step 1 — Solve your payment first (credit → points).

Quick size: Needed credit ≈ (your $/mo gap × 24). Use only if payback ≤24 mo.

Seller balks? Keep a smaller credit and reduce points (don’t jump to price yet).

Step 2 — Trade structure, not dollars.

Swap to certainty terms: fully underwritten approval, short inspection window, flexible close, seller-paid lock extension.

Step 3 — Price is the clean-up hitter.

If payment is close but not there, finish with a small price shave.

Fast math at today’s rates: ≈ $6–$7/mo per $1k price drop—use it to bridge the last $25–$50/mo after credits.

At-a-glance impacts (typical ranges):

2% credit → points: ≈ $110–$150/mo (increases your cashflow)

$10k price cut: ≈ $60–$70/mo (increases your cashflow, just not as much)

Lock extension paid: avoids re-lock cost; preserves your plan

🎯 ONE ACTION (90 seconds)

Save a search named “DOM ≥60 + Cut — [ZIP]”. When one hits, run Two-Call, compute your $/mo gap, and ask for a credit sized to that gap. If payback >24 months, downshift to a small credit + minor price shave.

🌐 SOURCES

PMMS (Nov 20): 30-yr fixed 6.23%. Freddie Mac

NAR (Oct): Inventory ~4.4 MOS. National Association of REALTORS®

Realtor (Oct): Time on market ~63 days, active listings up 17% YoY. Realtor

Apartment List (Nov): Rents −1% YoY; vacancy 7.2%. Apartment List

TradingEconomics: Housing data, downloadable charts

⚖️ COMPLIANCE

Education for real estate investors, not financial/legal/tax advice. Investment property taxes and insurance requirements vary significantly by location. Always verify non-homestead rates and landlord insurance requirements before making offers.

Until next time,

Your 10-minute real estate playbook starts here