THE DEED BRIEF

⚡︎ THE SHORT VERSION

Vacancy is easing, new construction is slowing, and rent growth is modest but steady — the sweet spot for investors who want predictable returns.

At the same time, over 30% of U.S. sales are now all-cash, tightening competition for financed buyers.

This week’s Deed Brief walks you through where momentum’s shifting and how to level the playing field — even if you’re not writing cash offers.

📊 SNAPSHOT

Multifamily’s quiet rebound

National vacancy rates dipped for the first time in 12 months.

New multifamily starts are down ~8%, which means less supply coming online.

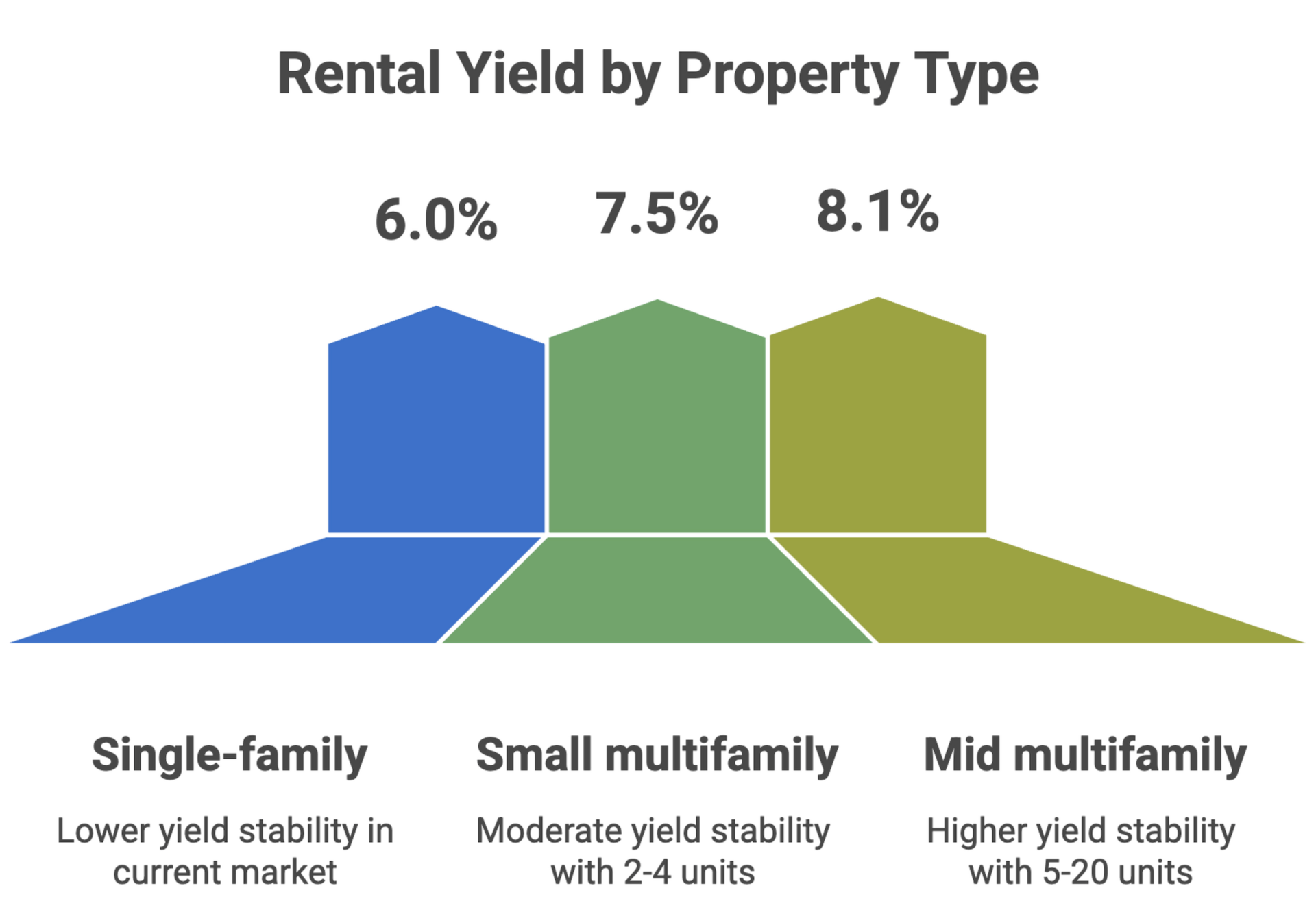

Investors are focusing on 2–8 unit properties for stable income + light value-add.

💡 Investor takeaway

Flips and short-term rentals face volatility. Multifamily offers steadier yield and control.

👉 So what: If you’ve been waiting to scale, the math is shifting in your favor.

🎯 Action idea

Start watching small apartment comps within your metro — sellers are more flexible than you think.

💰 CASH IS KING AGAIN (but not unbeatable)

Nearly 1 in 3 home purchases is now cash (Redfin, Q3 2025). Sellers lean toward certainty, not always the highest price.

💡 Investor takeaway

If you’re financed:

Structure like cash → shorten contingencies, show proof of funds, or get a pre-underwritten letter.

Ask for credits → sellers are more open to financing incentives than big price drops.

Partner smart → private money or JV capital can level the field fast.

👉 We built a Mini-Tool to help:

🔎 MINI DEAL DECODER

When to go multifamily instead of single-family

Pocket rule:

💡 If rent-to-price ≥ 0.9% and Months of Supply (MOS) > 4.5 in your metro → multifamily wins.

Why: more cushion for debt, lower reliance on appreciation, and stronger cash flow in a flat market.

🧭 Bonus: See page 8 of the guide for “When These Strategies Work Best.”

💰 FUNDING FOCUS — CREATIVE FINANCING MOVES

Creative Financing Moves

Seller finance

Pitch it when properties have been listed 60+ days and you sense fatigue.

Wrap financing or sub-to

Still niche, but useful when rates are locked low.

Credit leverage

Ask lenders for a “buydown + credit mix” to simulate a 5% handle rate.

🎯 ONE ACTION THIS WEEK

Find one duplex–fourplex in your metro with 45+ DOM (days on market) and no recent price cut.

Run a side-by-side: standard finance vs seller-credit scenario.

You’ll see where the gap — and leverage — really sits.

🧩 MICRO-GLOSSARY

MOS (Months of Supply):

How long it would take to sell current inventory at the current sales pace.

4–5 = balanced; >6 favors buyers; <4 favors sellers.

Buydown:

Up-front payment that lowers your interest rate and monthly payment.

Credits:

Seller or lender funds applied at closing to reduce your payment or cash-to-close.

JV (Joint Venture):

A short-term partnership where two or more investors combine resources—one may bring capital while the other manages the deal. Used for flips, small multifamily, or bridge acquisitions when speed matters.

⚖️ Compliance

This is education, not financial/legal/tax advice. Markets and rules vary by city/state/property. Validate local regulations, property taxes, insurance, and loan terms before acting.

READ NEXT:

📚 SOURCES

Until next time,

Your 10-minute real estate playbook starts here

P.S. Prefer reading in Spanish? Just reply with the word SPANISH and we'll switch you over.