THE DEED BRIEF

📊 THIS WEEK’S POLL

Which pipeline signal would you like us to track for your metro each month?

LAST WEEK’S RESULTS

What signal do you track most?

Results:

Net mover inflow (PODS/United): 50%

Payroll jobs (BLS QCEW): 33%

Talent inflow (LinkedIn): 17%

Street-by-street only: 0%

Our take: Readers lean toward household inflow first, then payroll growth—which tracks with how rent demand shows up on the ground: people arrive → jobs keep them → rents stabilize. Talent inflow (LinkedIn) is useful, but you’re telling us it’s a secondary confirm, not the lead signal.

How to use this (1 minute):

Lead with movers for direction, jobs for staying power.

If both are positive, underwrite base rent (short concession window). If either is soft, use effective rent and a longer burn-off.

Keep LinkedIn as your tie-breaker when movers and jobs disagree.

( 🙏 Thanks for voting—this helps us prioritize which signals we track for you each week.)

⏳ TL;DR

Q: How do permits/starts change my deal underwriting right now?

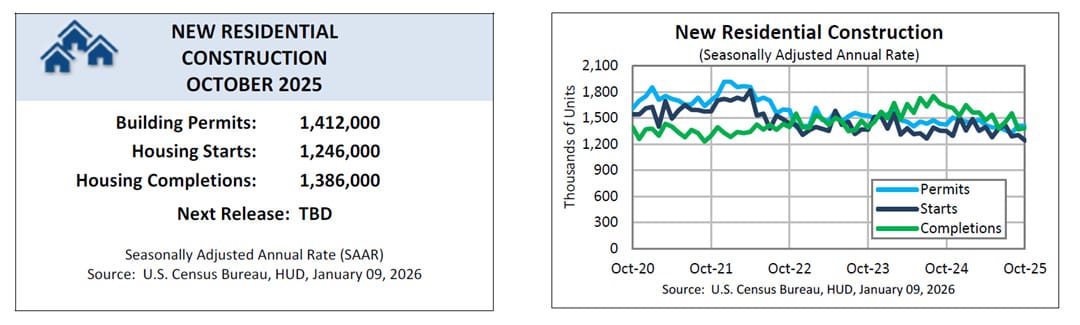

A: The latest New Residential Construction shows permits 1.412M SAAR, starts 1.246M SAAR (Oct ’25). Single-family is holding better than multifamily; completions remain elevated. Translation: many metros will keep seeing multifamily lease-up pressure (concessions) while SF rental stock stays tighter. Census Data

🧲 MARKET CHECK (INVESTOR INTEL)

Interest Rates: 30-yr fixed averaged ~6.06% the week ending Jan 15 - a tailwind for payments, not a miracle. Freddie Mac

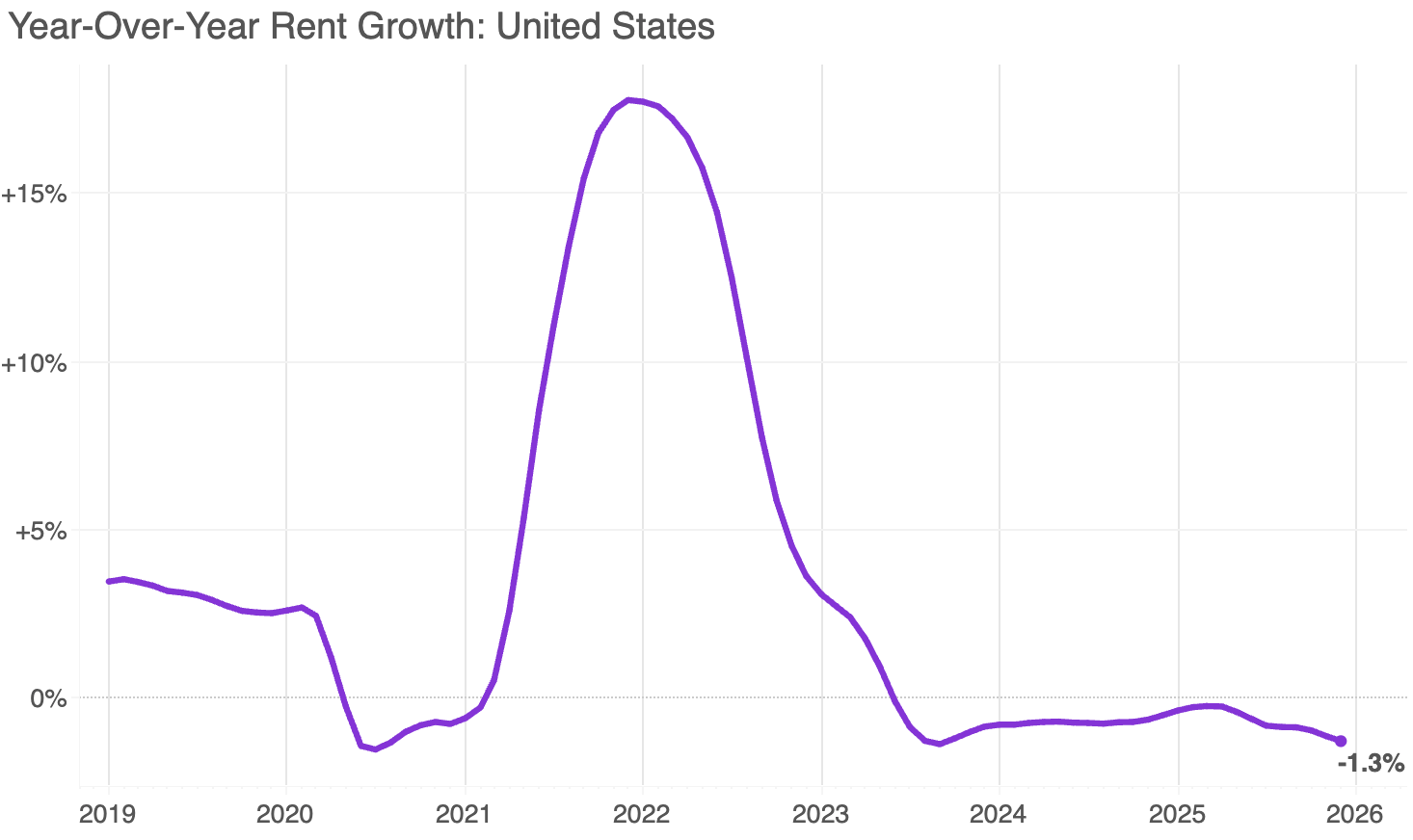

Rents/vacancy: National median rent down ~0.8% MoM Apartment List

🏡 THIS WEEK’S MOVE

THE 10-MINUTE “PERMITS→RENTS” CHECK

Goal: Decide if you should underwrite effective rent (promos baked in) or base rent (short promo window).

1) Confirm the national direction (2 min)

Open the Census Oct ’25 New Residential Construction release; note permits, starts, completions and SF vs MF split.

• New Residential Construction (Oct ’25) → (press release & tables).

2) Grab your state/metro permits (5 min)

Use the Building Permits revised series (more granular) to see if your metro/county has a multi-family bulge coming. If yes, assume promos and longer burn-off near those clusters.

• Release schedule + coverage levels here.

3) Set your rent input (3 min)

If local MF (multi-family) permits/starts are high → use effective rent for Year-1:

(paid months × list) ÷ 12(subtract waived fees ÷ 12).If pipeline is thin and SF dominates → base rent with ≤60-day promo burn-off.

Always cross-check vacancy trend on Apartment List before you bid.

🧑💻 INVESTOR CORNER

HOW TO PLUG THIS INTO YOUR UNDERWRITING

Rent:

MF surge nearby? Underwrite effective rent + longer lease-up (90–120 days).

SF-heavy pipeline? Base rent + short promo window.

Vacancy:

MF-heavy pocket: 6–8% (temporarily higher).

Near-jobs SF pocket: 3–4% possible.

CapEx & turns: New supply can pull tenants up-market; budget for make-ready refresh faster than usual.

Timing: If a big MF project delivers in Q2–Q3, model your concessions until Month 15 (renewal) before stabilizing to market.🔎 DEAL DECODER

🔍 DEAL DECODER

“Will new supply hit my rents?”

Use this two-line filter on every candidate:

Within 1–2 miles, how many MF (multi-family) units deliver in the next 6–12 months? (permit/starts + local planning dashboards)

Is SF (single family) inventory actually loosening, or flat? (permits/starts split + MLS new listings trend)

If MF deliveries are heavy and SF tight: buy only with effective rent penciled and a seller-credit path if Year-1 runs thin.

🎯 ONE ACTION (90 seconds)

Open the Census BPS schedule and bookmark it. On your phone, set a monthly reminder on the 12th & 17th workdays to check preliminary/revised permits for your target metro. Then refresh Apartment List for vacancy/concessions sanity.

• BPS schedule (prelim/revised)

🌐 ADDITIONAL SOURCES

Freddie Mac PMMS – Mortgage rate weekly.

NAR – Inventory & months of supply.

Apartment List National Rent Report — National Rent Report.

ATTOM – Q3 2025 Home Flipping Report.

New Residential Construction — Oct ’25 (permits/starts/completions) (press release + PDF tables).

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

⚖️ COMPLIANCE

Education for real estate investors, not financial/legal/tax advice. Investment property taxes and insurance requirements vary significantly by location. Always verify non-homestead rates and landlord insurance requirements before making offers.

Until next time,

Your 10-minute real estate playbook starts here