THE DEED BRIEF

📊 LAST WEEK’S RESULTS

Last week’s results: #1 hurdle = Rehab/contractor risk (71%); runner-up = Finding cash-flow at list (14%).

We’re building next week’s checklist around contractor selection + scope control.

⏳ TL;DR

Q: Should you flip or hold in early 2026?

A: Run this 10-second filter: Can the deal survive ARV × 0.90 with a 10%+ profit margin? Can it handle ARV dropping 3% and sitting 45 extra days? If no, congrats—you just found your next rental. Stop forcing flips. Run Two-Call for real monthly costs and win on cash flow, not gambling on appreciation.

WHAT MOST INVESTORS MISS

The time bomb: Every day costs money. 30 extra DOM at $150/day = $4,500 gone. That "profitable" flip just went red.

The contractor fantasy: That $30k rehab? Budget $35k and add two weeks. If that kills your profit, you never had a flip—you had hope.

The exit trap: No Plan B = amateur hour. Your property must cash flow at conservative rents (assume concessions) with full PITI + reserves. Otherwise you're speculating, not investing.

🧲 MARKET CHECK (INVESTOR INTEL)

Interest Rates: 30-yr loans ~6.21% Freddie Mac

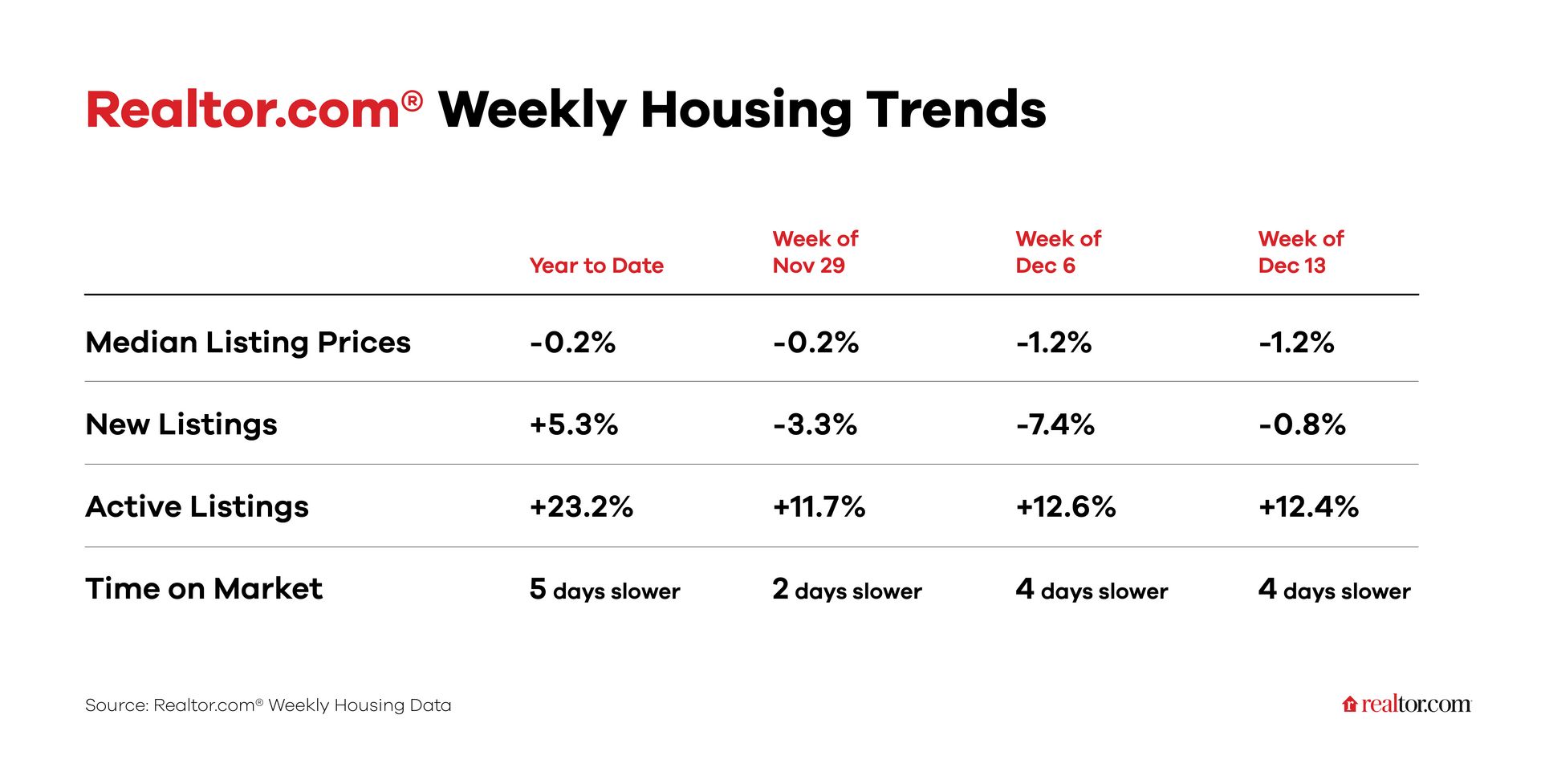

Read the full report: Weekly Housing Trends

Rents are down for the 28th consecutive month, read the November Rental Report

Gif by sincerehope on Giphy

🧑💻 INVESTOR CORNER

The Flip Update (What Changed Since Last Week)

Last week we said: Flips cooling, focus on buy-and-hold. That's still true for heavy rehabs.

This week's nuance: Flip VOLUME is up, but that's misleading—it's concentrated in light cosmetic plays with multiple exits. The cowboys doing gut rehabs? They're the ones getting crushed. ATTOM's data shows profits compressed to dangerous levels for traditional flips. Full data

What smart investors are actually doing: That SFR survey we referenced? Operators aren't abandoning flips—they're doing "flips with training wheels." Light rehab → test the market → convert to BRRR if it doesn't sell fast. Multiple exits is the new requirement. Details

Your 2026 flip filter (only consider these):

Cosmetic only — Paint, flooring, fixtures. If you see structural issues, you're already too deep.

Must work as rental — Run your Fit Check at conservative rents. Can't cash flow? Don't flip it either.

70% rule is now 65% — Tighter margins mean less room for error. ARV × 0.65 - repairs = max offer.

The bridge: Those buy-and-hold deals we pushed last week? They're still your bread and butter. These selective flips? They're the gravy when you find them. Don't force flips in this market—let obvious ones come to you.

Bottom line: We're not flip-positive. We're exit-flexible. Big difference.

🔎 DEAL DECODER

FLIP RISK MATH — 2026 QUICK TEST

IMPORTANT: Read the Home Flipping Report

Flips can still win—only when the spread survives time + carry. Run this before you swing a hammer:

1) True spread (not cosmetic)

Target: (ARV × 0.90) − All-in basis ≥ 10–12% of ARV (≥15% if DOM is rising).

2) DOM shock test (time kills IRR)

Pull median DOM for your comp set. Underwrite +30–45 days.

If profit/IRR dies with +30 days, it’s not a flip—it’s a hold.

3) Hold-cost per day

(Interest + taxes + insurance + utilities + HM fees + staging) ÷ estimated days.

Rule: Daily carry × DOM buffer ≤ 25–30% of projected gross profit.

4) Exit liquidity check

If price-cut share > 25–30% in your sub-market, haircut ARV 2–3% and rerun.

Breaks with a 3% trim? Pass (or convert to BRRR/hold).

5) Rehab slippage

Add 10–15% budget contingency and +2 weeks schedule. Still pencils? Proceed.

6) Financing friction

Include points + extension fees. If one extension nukes ≥20% of profit, basis is too tight.

7) Plan B (insurance policy)

Could you rent at conservative Year-1 and cover PITI for 6–12 months?

If “no,” demand a bigger spread.

🟢 GREEN FLAGS (GO)

Distressed basis (your edge), scoped reno < 8 weeks, sub-market with short DOM & low price-cut share.

🟡 YELLOW FLAGS (ADJUST or PASS)

ARV relies on the very top comps, soft rents (Plan B fails), or profit vanishes with 3% ARV trim / +30 days / +10% rehab.

Bottom line: Pros don't skip flips—they stress-test them to death. Run worst case: ARV drops 3%, timeline stretches 30+ days, rehab runs 10% over. Still shows strong profit? You found a real flip. Goes negative? That's your next rental or wholesale. This filter separates operators from speculators.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

⚖️ COMPLIANCE

Education for real estate investors, not financial/legal/tax advice. Investment property taxes and insurance requirements vary significantly by location. Always verify non-homestead rates and landlord insurance requirements before making offers.

Until next time,

Your 10-minute real estate playbook starts here